2 Month Due of Car Loan Malaysia

In conclusion we have to evaluate ourselves and our financial status well to be sure we can afford to purchase a vehicle. This is done to relieve those who are going through temporal financial constraints during these unprecedented times.

Festive Bonanza For Salaried Employees The Best Time To Buy Your Dream Toyota Harshatoyota Toyota Toyota Cars Good Things

Although the maximum is 9 years more often than not the advised number of years are between 3 5 and 9 years.

. We can buy a car costing RM63000 like an Alza. Estimate monthly car loan repayment amount. Alexis Open AP and Franchise AP Malaysian Road Tax.

Scenario 2 Tenure 7 years 84 months Interest rate per annum 3 Number of installment paid 60 months Early settlement penalty RM0 Again using our car personal loan calculator the early settlement amounts to RM1647395. Depending on the type of loan undertaken you may save money with early settlement. Despite your monthly instalment being less with a longer period of the loan the burden of higher interest rates and responsibility of a longer debt falls on you.

Depending on your loan amount and interest rate employed your monthly repayments will be bigger for shorter-tenured loans. As banks are exempt from the movement control order and operate as usual albeit with altered working hours new loans and financing applications can be. For a typical 7-year loan period their interest rate can go as low as 375 with a monthly payment of RM488.

Banks usually offer a maximum term of 9 years on the loan. Flat Rule of 78 Trap. The moratorium is basically a temporary freeze on loan repayments.

You have 21 days after to sort out the matter to avoid repossession. Paycheck stubs from the previous 3 months. Then you will be informed in about 3 days whether the loan is approved.

Generate principal interest and balance loan repayment table by year. After that you will be given the information about your loan and you can then drive your new car home. The Axias 33 litre fuel tank would cost up to RM6765 for a full tank of RON95 RM205l.

Typically most car buyers will choose a repayment term of 7 8 or 9 years. How does this make sense to you. The earlier we prepay - The more interest we save - But the more capital we need.

The effective interest per year saved due to early settlement is only 055. If you are buying a car and if you need financing limit your loans tenure period to no more than 5 years. Enter car loan period in Years.

You can ask your bank about the rebate amount. Enter car price in Malaysian Ringgit. The requirements are similar to those of a loan from an American institution.

Interests will continue to accrue every month as usual. The notice is intended to inform you that the bank is planning to repossess the car. Recently the topic of Rule of 78 has been gaining traction after one Said Din shared on Astro Awani about his bad experience in making an.

If youve missed your car loan payment for two consecutive months your bank will send you and your guarantor a pre-possession notice also known as a Fourth Schedule notice. In most cases a rebate will be given when a car loan in Malaysia is settled early. Most banks including the ones we corresponded with confirmed that as long as you have a performing auto loan HPA with a repayment due on April 1st it qualifies for the 6 month moratorium.

If you are loan is approved the bank will inform the salesman and the amount is transferred between them. At a salary of RM6000 minus the cost of living the remaining amount is RM 1500 which means we can only afford to buy a car that costs RM750 per month loan 9 years. 29 33 Effective Interest Rate is 55 62 Opportunity Cost.

Early settlements Early settlements of your car loan in Malaysia can save you money but this depends on the loan type youve chosen. With a valid visa and a decent credit rating most expats are able to get loans from a Malaysian bank. You can expect fast approvals and hassle-free processing as long as you have all the requirements checked out.

The amount of interest savings from prepayment depends on when we prepay. According to new and used car e-commerce platform Carlistmy it costs roughly RM2500 for basic maintenance not inclusive of tyres and brake pads of a Perodua Axia for the first five years which is about RM50 a month. In Malaysia you may take out a car loan for a minimum of 1 year to a maximum of 9 years.

For those who do not know Bank Negara Malaysia BNM granted a moratorium on loan repayments including hire purchase or more commonly known as car loans for 6 months from the 1st April to 31st September 2020. For an expat to apply for a loan they should make sure they have these documents. This is because people generally dont have a couple of hundred thousand ringgit just lying around.

A car is considered a long-term investment so the most common way to pay for one is through a loan you get from a bank. Bank Negara Malaysia have announced a 6-month moratorium for all bank loans except credit card balances starting 1 April 2020. If you do then paying for a car in cash will eliminate interest rates but well get into that later.

Enter down payment amount in Malaysian Ringgit. Generate principal interest and balance loan repayment chart over loan period. However do remember that the moratorium applies only to loan repayments.

Hyundai Starex Royal Hyundai Leather Seat Suv Car

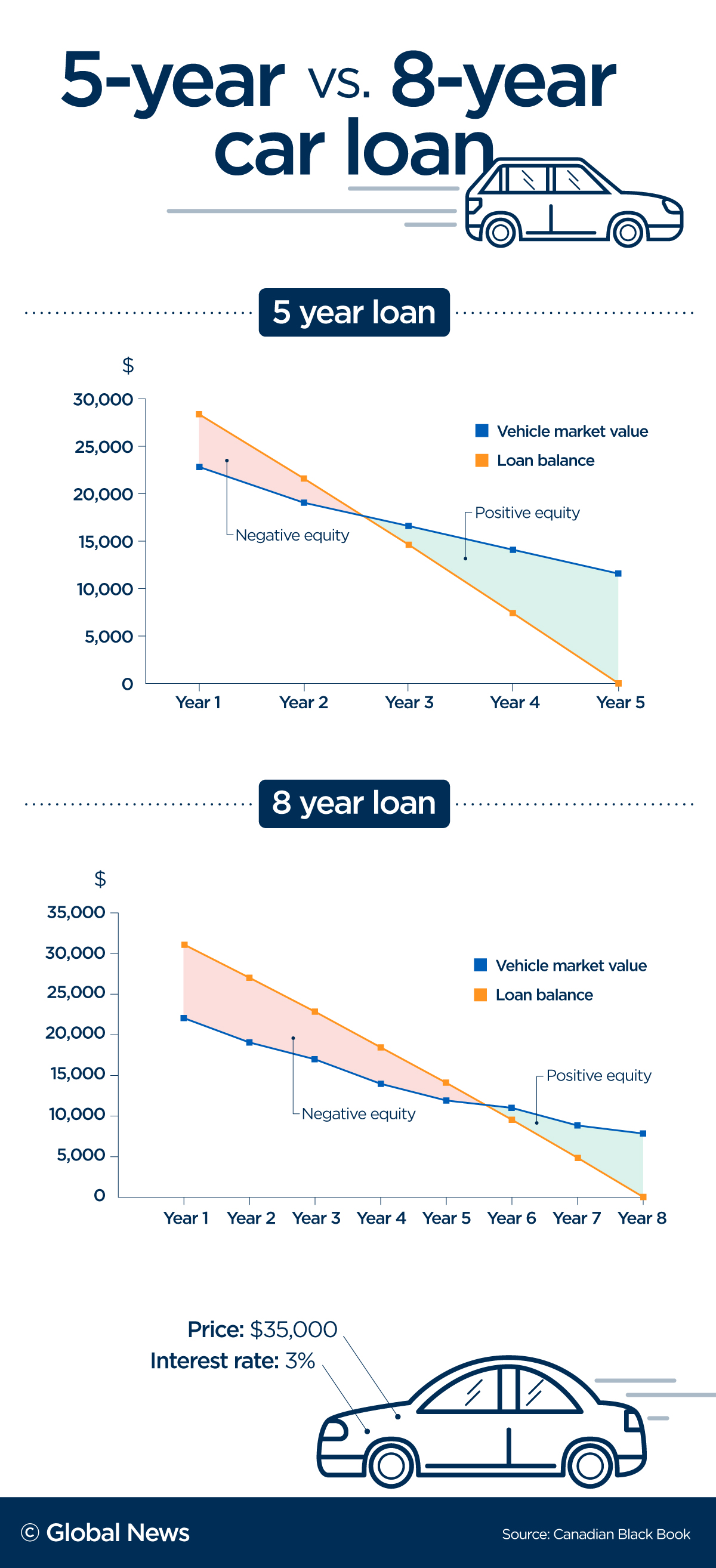

Your Car Loan Payment May Be Way Too High Here S What S Happening National Globalnews Ca

Malaysia Ringgit Loan Cash Loans Finance Loans

Lending Money Contract Template Free Fresh Loan Agreement Letter Loan Contract And Agreement Contract Template Lettering Elementary Lesson Plan Template

6 Dos And Don Ts Before Applying For A Car Loan Mint

Loan Calculator That Creates Date Accurate Payment Schedules

Comments

Post a Comment